The South African economy grew by 0.4% in the second quarter. The growth rate was slightly weaker than economists expected. According to polls by Reuters and Bloomberg, their median estimate was 0.5%.

After previously reporting that real gross domestic product (GDP) contracted by 0.1% in the first quarter of 2024, Statistics SA revised this number to 0.0% (unchanged).

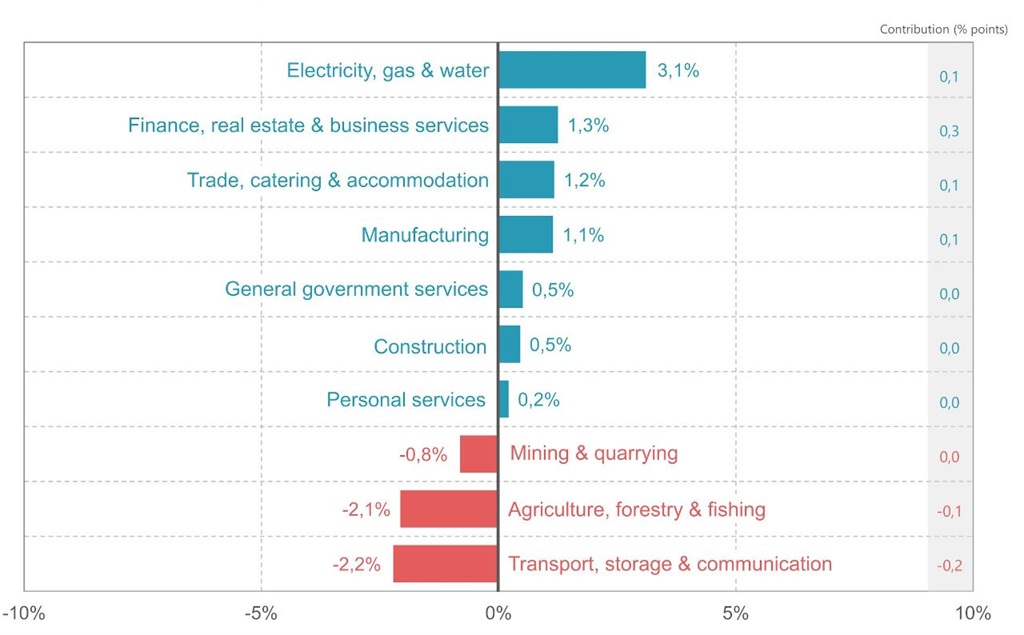

The finance, manufacturing, trade, and electricity, gas and water supply industries drove most of the economy’s momentum in the second quarter, reports Statistics SA.

The quarter was entirely without load shedding, which has now been suspended for more than 150 days. As a result, the electricity, gas and water supply industry grew by 3.1% over the quarter – the sharpest increase since 2008.

Manufacturing also grew after shrinking in the first quarter, rising by 1.1% in the second quarter thanks to vehicle and food production. The construction industry showed some growth after contracting for a full year, edging 0.5% higher in the second quarter.

“The rise was driven by economic activity related to residential and non-residential buildings. However, there was a slowdown in construction works,” reports Statistics SA.

For the second consecutive quarter, the mining sector was in decline. Production of iron ore, coal, diamonds and gold all fell. The agriculture, forestry & fishing sector shrank by more than 2%. According to Statistics SA, this was due to lower-than-expected rainfall in some parts of the country which affected maize and soya bean production, while heavy rain in KwaZulu-Natal hit sugar cane production. In addition, foot-and-mouth disease hurt sheep and pork production.

Business confidence is expected to have improved notably in the third quarter thanks to the extended suspension of load shedding and increased political uncertainty following the election, says Investec economist Lara Hodes.