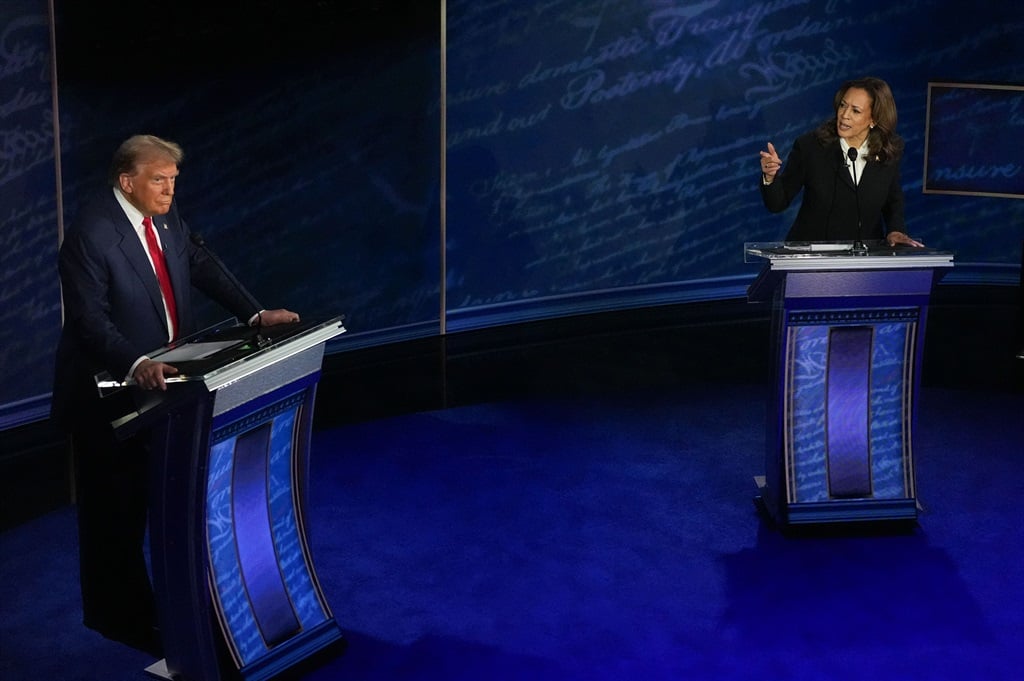

Former President and Republican presidential candidate Donald Trump and Vice President and Democratic presidential candidate Kamala Harris during the first presidential debate in Philadelphia. Photo: Demetrius Freeman/The Washington Post via Getty Images

The dollar slumped more than 1% against the yen on Wednesday to its weakest level of the year after Kamala Harris put rival Donald Trump on the defensive in the only scheduled debate of the US presidential race.

Traders were also waiting nervously for a key US inflation report that could provide clues on how aggressively the Federal Reserve cuts rates next week.

The dollar dropped as much as 1.24% to 140.71 yen, a level not seen since December 28. The rand also strengthened against the dollar. It was last trading at R17.86/$, from R17.94 overnight.

The dollar index – which measures the currency against six major peers – slipped 0.33% to 101.31 after rising to a one-week top at 101.77 on Tuesday.

Vice President Harris, the Democratic candidate, put former President Trump on the defensive in a combative debate, with a stream of attacks on abortion limits, his fitness for office and his myriad legal woes.

She also received a boost from pop megastar Taylor Swift, who told her 283 million Instagram followers that she would back Harris and running mate Tim Walz in the Nov. 5 election.

Following the debate, online betting site PredictIt showed Harris’ odds of winning improving 2 cents to 55 cents for a $1 payout, while Trump’s chances dropped 5 cents to 47 cents.

“Harris was seen as winning the debate, leading to a decline in US yields and a weaker dollar as a result,” said Shinichiro Kadota, a currency strategist at Barclays in Tokyo.

“That was the key factor” behind the plunge in the dollar-yen pair, with Nakagawa’s comments supporting the yen “at the margin,” he said.

Investors broadly see the dollar strengthening in the event of a victory by Republican nominee Trump, as tariffs might prop up the currency and higher fiscal spending could boost interest rates.

“Momentum is still for a weaker dollar-yen,” Kadota added. “Even if we break 140, I wouldn’t be too surprised.”

The dollar has not been below 140 yen since July of last year.

The yen received an additional boost from Bank of Japan board member Junko Nakagawa, who reiterated in a speech that the central bank would continue to raise interest rates if the economy and inflation move in line with its forecasts.

The euro gained 0.25% to $1.1048, recovering from its overnight slide to $1.10155 for the first time since Aug. 19.

Sterling rebounded 0.19% to $1.3105 following its drop to $1.3049 in the prior session, the weakest since Aug. 21.

The US Federal Reserve looks set to ease policy on September 18 for the first time in more than four years, although traders are split on the size of the expected rate cut.

Fed funds futures indicate a 67% chance of a standard 25-basis point reduction, and 33% odds of a super-sized 50 bps, according to LSEG calculations.

By contrast, the majority of economists surveyed by Reuters last month predicted the BOJ will raise rates again by year-end, although no change is expected at the next meeting on Sept. 19-20.

The immediate focus for U.S. economy watchers is the CPI report due later on Wednesday, with headline inflation forecast to have risen 2.6% year-on-year in August, according to a Reuters poll, slowing from 2.9% in July.

“Markets want to see evidence that inflation is behaving in a way that allows the Fed the wriggle room to cut 50 basis points if it needs to,” said Kyle Rodda, senior markets analyst at Capital.com.

At the same time, “a significant downside surprise would not be welcomed by the market because it could be interpreted as a sign of an unfolding demand shock,” Rodda added.

Additional reporting by News24.