Justice Minister Thembi Simelane. (Luke Daniel/News24)

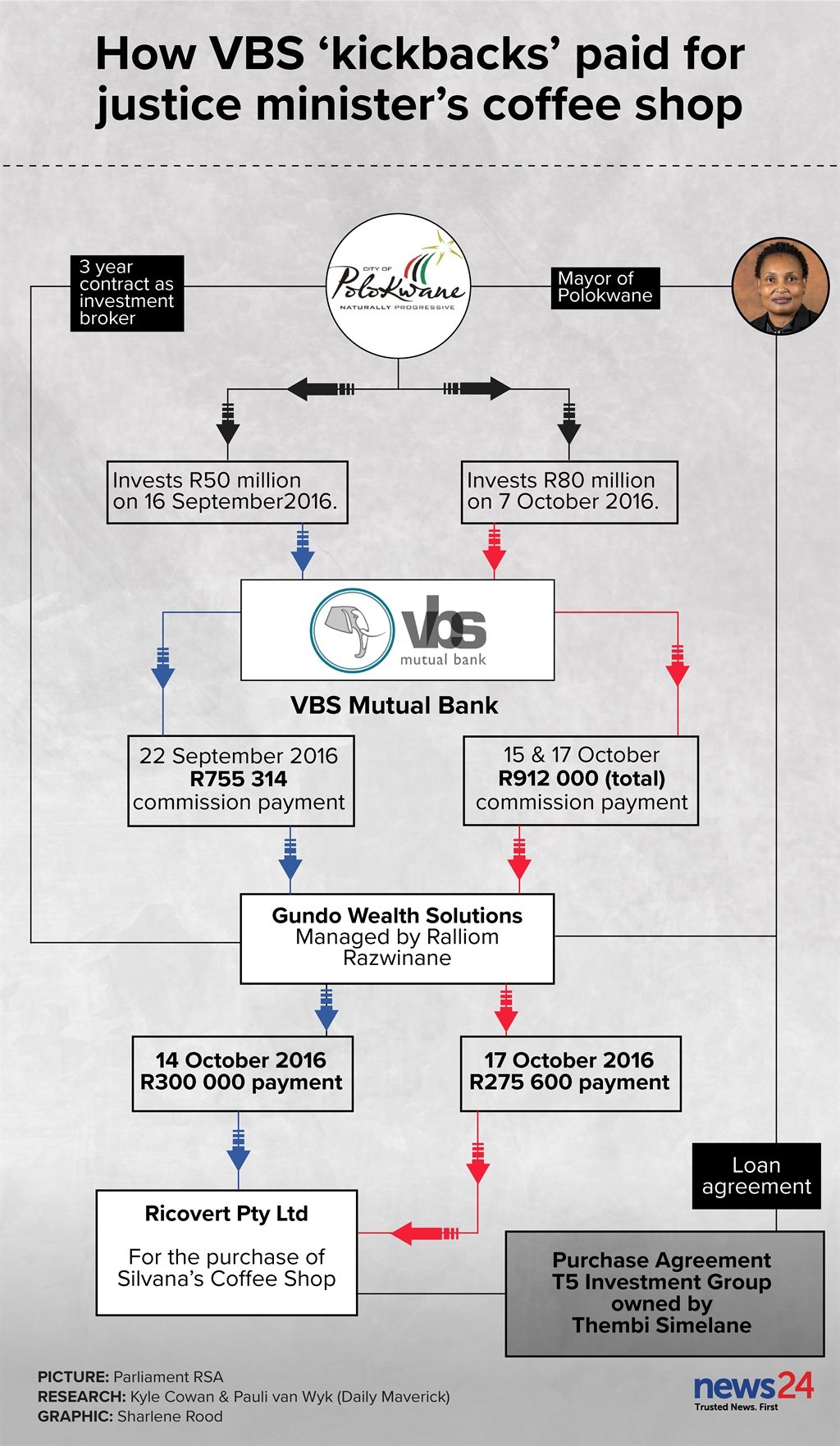

- Gundo Wealth Solutions provided a R575 600 loan to Justice Minister Thembi Simelane.

- The loan was paid directly to the owner of a coffee shop in Sandton, which Simelane was purchasing, in late 2016.

- At the time, Simelane went by her ex-husband’s surname, Nkadimeng, and was the mayor of Polokwane.

Justice Minister Thembi Simelane took a loan of more than half-a-million rand from a company that brokered unlawful investments of R349 million into VBS Bank by the Polokwane Municipality – while she was mayor of the city in 2016.

She used the “commercial loan” of R575 600 from Gundo Wealth Solutions, owned by Ralliom Razwinane, to purchase a coffee shop in Sandton.

But Razwinane and Gundo also brokered investments on behalf of VBS Bank – and the Polokwane Municipality, where Simelane was mayor, invested R349 million in the bank.

When VBS imploded in March 2018, forensic investigations found it had rewarded Razwinane with kickbacks totalling R24.2 million for brokering investments from various municipalities and state entities.

Investigators found these to be corrupt transactions and contraventions of the Municipal Finance Management Act.

Razwinane is currently on trial for fraud, corruption and money laundering for his role as commissions agent connecting municipalities, including Polokwane Municipality, with VBS Bank.

As justice minister, Simelane oversees the National Prosecuting Authority (NPA), which is actively involved in investigating and prosecuting the collapse of VBS Bank.

READ | VBS Bank Scandal: Victims demand justice as former chair admits to multi-billion rand fraud

She is also a member of the justice and crime prevention cluster in Cabinet, which includes the police and the Hawks, who remain seized with the VBS matter.

She was Polokwane mayor between 2014 and 2019 and was appointed justice minister in June.

Kickbacks for investments

Simelane used the “loan” to buy the coffee shop in two transactions in October 2016. The payments appear to be linked to kickbacks received in exchange for large investments by the Polokwane Municipality in VBS.

During October 2016, VBS paid a total of R1.66 million in kickbacks to Razwinane and Gundo Wealth Solutions in exchange for two investments, totalling R130 million, from the Polokwane Municipality. The investments came about shortly after Gundo signed a three-year contract to provide investment brokerage services to the municipality.

In turn, Razwinane paid R575 600, almost 35% of his kickbacks, to a company called Ricovert, the then-owner of Silvanas Coffee Shop on the ground floor of Fredman Towers, in Sandton.

Simelane has confirmed the Ricovert transaction was in aid of her purchase of the business. She characterised the deal as a legitimate “commercial loan”, which was “fully repaid” and said that “the transaction was completely above board”.

Simelane’s deal is cast against at least five investments the Polokwane Municipality made into VBS between September 2016 and May 2017, totalling R349 million. For each of these investments, Razwinane received kickbacks from VBS.

Simelane, who previously went by the surname Nkadimeng, offered assurances of her commitment to “the practice of ethical leadership” and welcomed “any legitimate scrutiny into her affairs, including her private business affairs”.

She did not, however, provide the “commercial loan” agreement or proof of settling the loan – information she claims exists.

Simelane pointed out that Gundo was registered as a financial services provider.

However, she did not reply to follow-up questions highlighting that Gundo was, in fact, not a registered credit provider and could, therefore, not offer loan services.

Nor did she comment on the apparent conflict of interest created when she used Gundo as her personal service provider while the company offered “advice” to the municipality where she was the mayor.

A joint investigation by News24 and Daily Maverick based on bank statements, indictments, former VBS bank chairperson Tshifhiwa Matodzi’s plea deal, a report by advocate Terry Motau, and unpublished reports from investigators Crowe Forensics and law firm BDO, suggests that the transactions are questionable.

Buying Silvanas Coffee Shop

Between September 2016 and May 2017, the Polokwane Municipality made at least five unlawful investments in VBS Bank, totalling R349 million.

Unlike other municipalities, which lost large amounts when VBS imploded, Polokwane retrieved all its money in time, with one report outlining that it expected around R12 million in interest, without any clear indication if that is how much the municipality made.

Around March 2016, Gundo signed a deal with the municipality as its “investment broker and manager”, investigators at BDO found in a probe sanctioned by National Treasury.

The first unlawful investment that Polokwane Municipality deposited into VBS was R50 million, around 16 September 2016. Six days later, around 22 September 2016, VBS paid a total of R755 314 to Gundo – about 1.5% of the first investment.

In an indictment submitted to court, prosecutors described these payments to Gundo as cash meant to solicit the first investment and used for “corrupt payments to various municipal officials, both known and unknown to the state”.

Simelane is not named in the indictment.

According to the indictment, the transaction was in contravention of several sections of the Prevention and Combatting of Corrupt Activities Act.

Sources familiar with the investigation said one of these “corrupt payments”, for the benefit of a “municipal official”, was paid towards a coffee shop. A report by Crowe Forensics flagged the transaction for further investigation by law enforcement.

Bank statements show that Gundo paid R300 000 to Ricovert about a month after the first R50 million investment. The payment descriptions were “Silvana loan” and “Silvanas sale”. Ricovert, at that stage, owned the Silvanas Coffee Shop at Sandton’s Fredman Towers in Fredman Drive.

A second unlawful investment by the Polokwane Municipality was deposited around 7 October 2016 and totalled R80 million. Tied to this investment, Gundo received a kickback totalling R912 000. This calculates to about 1% of the second investment.

Gundo then proceeded to make another payment of R275 600, to Ricovert. The payment descriptions were again “Silvana loan” and “Silvana”.

The payments to Ricovert for Silvanas Coffee Shop amount to almost 35% of the two R755 314.31 and R912 000 kickbacks Gundo received from VBS.

Simelane declined to answer specific questions, but did admit that Gundo’s payments to Ricovert were made on her behalf.

According to Simelane’s version, the R575 600 was “a loan” for “the purchase of a coffee shop business”. She states the “loan in question has since been paid in full”, but did not respond to requests for supporting documents to prove this version.

Three years later, in 2019, she registered a company, named Silvanas Bistro, to manage the business, apparently around the same time she was questioned by investigators.

Simelane explained that she was a client of Gundo at the time, who was her financial adviser.

Trouble brewing

Simelane does not believe there is a conflict of interest between her previous involvement with VBS and her position in the executive.

“There will be no conflict of interest. The minister is the first to insist on the independence of all law enforcement agencies. The NPA has the minister’s full support to discharge its constitutional mandate without fear, favour or prejudice,” she said in a written response to questions

The commission agent scheme run by VBS management was identified as an illegal method used to bribe municipal officials to make “massive deposits” into the bank, the extensive Motau and Werksmans-probe into the implosion of VBS found in 2018. Motau’s report, titled The Great Bank Heist, set out the findings in detail.

Razwinane was charged in 2021 with 13 counts of the contravention of anti-corruption legislation related to the commission agent scheme.

A request for Simelane’s declarations of interest to the Polokwane Municipality, covering this period, has yet to be responded to.

Razwinane read, but did not respond to detailed questions.

This was a joint investigation by News24 and Daily Maverick.