Annual consumer price inflation decelerated for a second consecutive month to 5.2% in April from 5.3% in March.

The April outcome was below economists’ expectations, but SA’s consumer inflation rate still hasn’t been under 5% since August last year and even then, it only achieved a drop beneath 5% for two months in the whole of 2023.

The main drivers of inflation were housing and utilities, miscellaneous goods and services, food and non-alcoholic beverages and transport, according to Statistics SA.

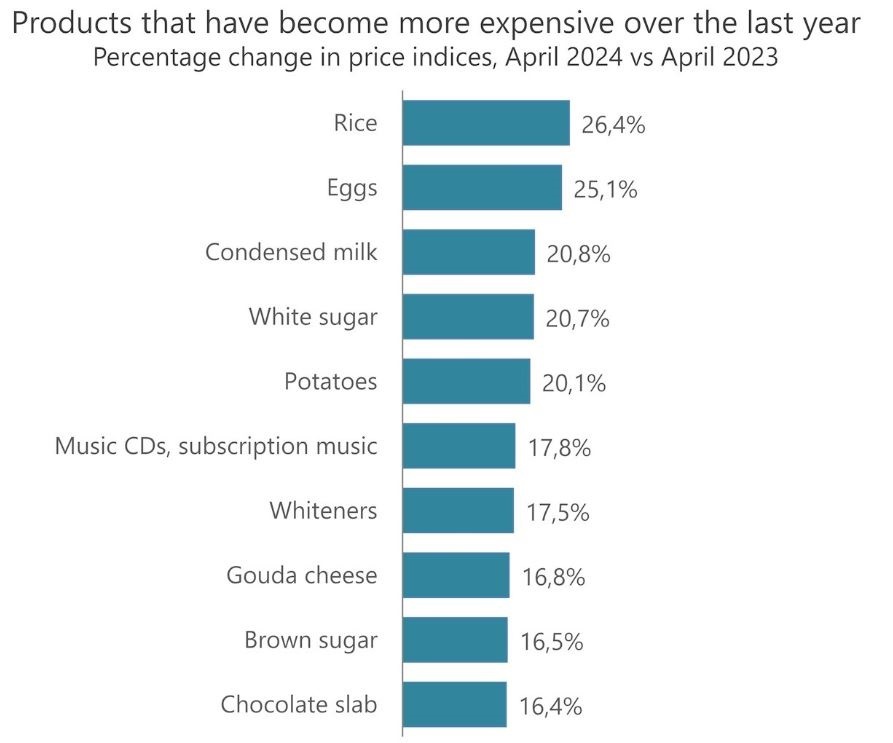

“Annual inflation for food and non-alcoholic beverages moderated further from 5.1% in March to 4.7% in April, representing a fifth consecutive month of decline. Most food and non-alcoholic beverages sub-categories witnessed lower annual rates, except for vegetables, fruit and hot beverages,” Statistics SA said.

On average, vegetable prices increased 7.4% in the 12 months to April, higher than the 6.0% increase recorded in March.

While still high, the annual rate for sugar, sweets & desserts cooled to 16.8% from 17.8% a month earlier. Inflation for products such as white sugar, brown sugar, chocolates and jam remained elevated and egg inflation recorded its fifth consecutive month of decline after peaking at 39.9% in November and receding to 25.1% in April.

Fuel prices increased by a monthly 1.9%, pushing the annual rate to 9.0%, according to Statistics SA.

READ | Potential good news: June fuel prices on track for cuts

At the beginning of May, petrol prices rose 37c a litre to the highest levels in seven months. But recent estimates from the Central Energy Fund show the price of 95 unleaded petrol is due for a decrease of around 62c a litre, while the wholesale price of diesel could also be lowered. But conflict in the Middle East continues, the rand has been volatile and the final fuel prices for June will only be set at the end of May.

The consumer price index (CPI) increased by 0.3% month-on-month.

READ | In the interest of the poor: SARB defends its inflation stance as the picture gets uglier

The SA Reserve Bank has been clear that it won’t consider cutting interest rates, which are at a 15-year high, until consumer inflation is more consistently closer to the midpoint of its target range, which is 4.5%.

With this stance and rising fuel costs and sticky inflation, there’s a rising risk that rates won’t be cut this year.